All Blogs

Accounting

Mitigating vendor risk & effective compliance strategies

In this post, we’ll explore vendor risk management, why it's essential, and provide actionable strategies for effective vendor compliance.

Accounting

Revamping accounts payable: Manual vs. automated processes

Learn how transitioning from manual to automated processes can revolutionize your Accounts Payable department while avoiding potential pitfalls.

Accounting

AP Automation 101: Streamlining your Accounts Payable process

In this post, we’ll explain AP Automation 101 and show how it changes the game. Say goodbye to late payments—it's a win-win. Beyond efficiency and cost savings, there are layers of benefits; they're just waiting for you to explore.

Accounting

What to expect at Sage Transform 2024

The Routable team is proud to be a Platinum sponsor and exhibit at the conference from February 26-29 in Las Vegas. Stop by booth 6 to meet the team, see our AP Automation platform in action with Sage Intacct, and enter for a chance to win an Apple iMac or AirPods Max.

Product

Effortless international payments for Sage Intacct

We’re excited to announce our official release of international payments for Sage Intacct! Routable makes sending payments across borders a breeze.

Product

International payments for QuickBooks Online

We’re excited to announce our official release of international payments for QuickBooks Online! Send payments to over 220 countries and always stay in sync with your accounting software.

Accounting

Tax management essentials: What you need for year-end filing

In this blog post, we’ll go over common tax forms and deadlines related to gig and contract workers and look at how Routable can help you successfully file for your non-employee workers and entities.

Accounting

What’s the difference between RTP and ACH payments?

The biggest difference between ACH and RTP is the processing speed of each payment: RTP processes instantly whereas ACH can take hours or days.

Accounting

How OCR technology accelerates your AP process

OCR invoice processing is one of the must-have technologies for a fully automated AP department. Learn the benefits and how to get started.

Company News

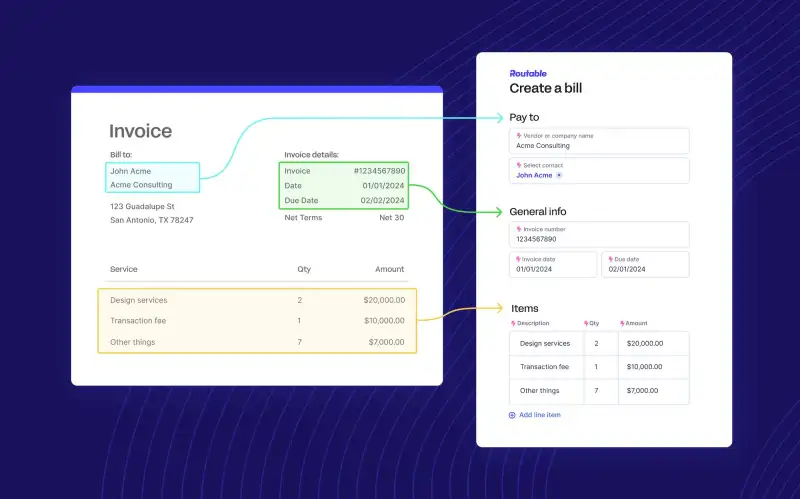

Routable introduces Optical Character Recognition automation to cut invoice processing time by 60%

OCR automatically scans invoices to create payables, making it possible for enterprise and mid-market companies to maximize payout automation.

Accounting

How AP automation solves marketplace payout challenges

Learn how the right AP software solves common B2B marketplace payment challenges for both your sellers and your AP team.

Developer

How Routable’s support system sets you up for success

Our customer support system emphasizes communication and education via Customer Success, Tech Support and API support from Developer Advocates.