How OCR technology accelerates your AP process

Carlene Reyes

| October 13th, 2022

Growing B2B payment volume is a good sign that your business is thriving, but it’s also when manual processes start weighing down day-to-day operations. With each invoice that rolls through to accounts payable (AP), teams have to manually enter data into their accounting systems — and it only gets tougher to manage as the number of invoices goes up.

Ninety-three percent of businesses that process mass payouts expect their monthly payables to increase over the next three years, which leaves finance departments turning to automation to help them meet demand. OCR invoice processing is one of the must-have technologies for a fully automated AP department, and ahead, we’ll cover how this technology works, including the benefits it offers your teams. Toward the end, we offer one payout solution option with invoice OCR to automate your entire AP process.

What is OCR invoice processing?

OCR stands for optical character recognition, and it’s the ability for computer systems to read and capture text from a digital file (e.g., a PDF) and convert it into editable data. OCR in accounting is most often seen in invoice data extraction. By automating the collection of key information, OCR invoice processing lets AP teams spend less time manually entering data to reduce the risk of costly errors. This benefit alone is why AP OCR is considered one of the most important features when automating AP processes.

How OCR invoice processing works

OCR for invoice processing automates bill coding to kick off a streamlined AP process. How it works is quick and instant.

Step 1: Upload the invoice

The first step for invoice digitization is to upload an invoice to your designated AP inbox. You can do this either by email or manual upload. (It's common for vendors to send invoices by email, but paper invoices can also be scanned and forwarded to an AP inbox.) Most AP OCR systems will accept a variety of file formats, including PDF, Word, Excel and images like JPEG or TIFF.

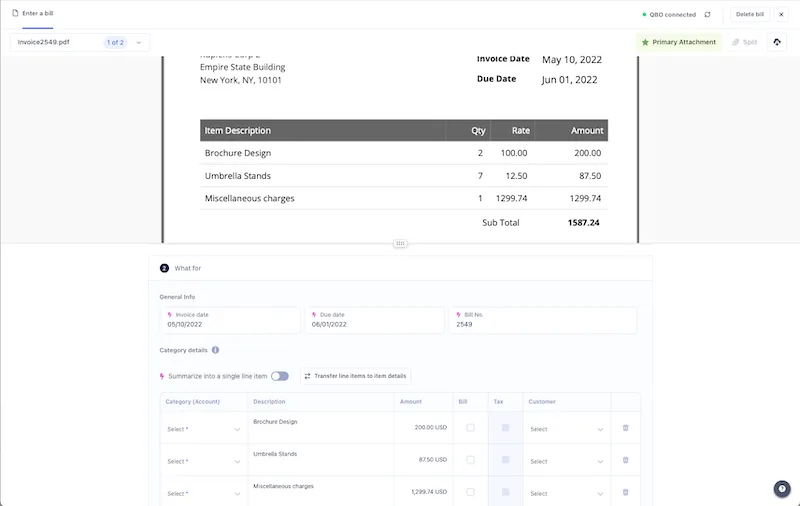

Step 2: OCR extracts the data

Once the invoice lands in your inbox, the invoice OCR data capture process begins. The OCR software reads core invoice data and converts it to digitized text.

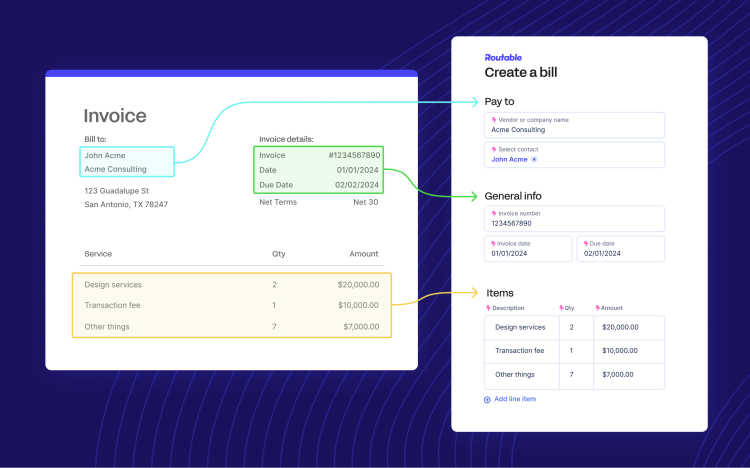

Captured fields include invoice header information like vendor name, invoice number, invoice data, due date, sales tax and the total. Data from line items like description and amount are also collected, along with quantity and unit price.

Step 3: A new payable is created from the OCR-extracted data

After OCR invoice data collection is complete, the captured fields are used to create a new payable in your AP system (or your accounting system if your AP platform is integrated) and populate payable details. Depending on the system used, more information (e.g., account codes) may be automatically populated at this stage.

The payment can then be assigned for review. From there, your AP team selects a payment method and delivery option. After the payment has been reviewed and sent through the normal AP approval process, the invoice is ready to be paid.

Benefits of an invoice OCR tool

Finance teams usually don't grow at the same pace as a company's profit centers, so making the most of your resources is vital. This is when OCR invoice automation helps you improve the speed and accuracy of your existing team (and give them a break from all that tedious data entry).

Here's a look at three ways that the right OCR accounts payable tool, as part of a larger AP automation system, will provide direct benefits to your finance team — and your company as a whole.

Invoice OCR reduces time spent on entering data manually

Invoice processing is a data-intensive job. Entering a new invoice for payment into your accounting software requires identifying the vendor, entering the invoice number, line items, amounts, the total and more. And after that data entry, account codes need to be applied.

OCR invoice processing reduces bill coding time by 60% or up to three minutes per invoice. That’s a whole lot of time saved when teams are getting hundreds or thousands of invoices at a time.

Invoice OCR increases productivity

Accounts payable is an essential function in any organization, but it’s just one of the many responsibilities an accounting team can take on. Because OCR in accounts payable eliminates redundant manual entry, teams can spend less time on exhausting tasks and instead shift their focus to other high-value activities. With automation technology increasing output, the net result is a finance team able to devote more time to streamlining their month-end close, managing budgets, forecasting and more.

Invoice OCR cuts down on manual-entry errors

Finance teams that manually code a high-volume of bills every month are naturally prone to making errors. By introducing OCR in accounts payable, you gain the ability to automatically populate invoice data and apply account codes based only on correct data. The speed and accuracy of OCR invoice processing gives you the confidence that things were done right the first time. Errors don’t have to be fixed at reconciliation time (such as recalling or reissuing payments from overpaid or underpaid bills), which means there’s less work for your team down the road.

OCR invoice processing is only a portion of automating your AP process

There's no doubt that invoice digitization can reduce manual entry errors and speed up invoice processing, but OCR on its own is not a complete solution. Because bill pay is only one of AP’s many responsibilities, finding a solution that automates your entire payables workflow is essential. To get the most out of OCR technology in accounting, it should be just one part of the AP automation software you choose. Consider these other AP software capabilities:

Real-time, two-way sync

If your AP platform doesn't offer a real-time, two-way sync with your accounting software, then OCR will only be so useful. Accounting integrations are essential to a comprehensive system that can optimize your entire AP process from receipt to settlement, automating all your essential AP functions, including processing, recording and reporting. Without a real-time, two-way syncing integration, an OCR invoice data capture tool will only help your team in coding payables and won’t provide any value when it comes time to reconcile payments to your accounting software.

For example, before an invoice can be paid, a vendor should already be recorded in your payables system. It's pretty standard for AP to maintain a vendor database that includes attributes like contact info, payment terms and credit limits. If you have an OCR solution that can scan in the vendor's name but cannot match it up to the vendor in your system, you've suddenly hit a wall with how useful automation can be for you. You’ll have to manually go into your accounting system to update that information, which is the exact opposite of what automation should be doing for you.

A flexible API

Every company is unique and scales up in its own way. This is where customizations to your systems and processes give you a competitive edge. If you have developers on staff, they can tailor your systems to your needs — but only if they can access the data from your AP automation software. This is why your automation system needs a fully functional and flexible API (Application Programming Interface) paired with an invoice data capture tool.

APIs allow you to quickly build a payments infrastructure that scales up as your company grows. Look for up-to-date API documentation, usage examples and a fine-grained access permissions system that will allow you to implement B2B payments that suit your core business model.

Using Routable for OCR invoice processing and full AP automation

Routable has everything your AP team needs to scale right along with the rest of your business. Our OCR solution works your way by giving you the option to upload or email one or multiple invoices/attachments. No matter how you receive invoices, we've got you covered. And if you need bulk processing, you can leverage our sophisticated API (or CSV upload for non-developers) to automate mass importing and make it a breeze.

Routable's OCR invoice processing automatically selects core invoice data like Vendor Name, Invoice Number, Invoice Date, Due Date, Sales Tax and Total along with more detailed line item data like Description, Quantity, Unit Price and Amount. When your AP team reviews the invoice, they can easily note auto-filled data, giving them confidence the correct information was imported.

From there, Routable offers the complete package to automate your payables and reduce the workload for your teams when sending payouts at scale. Routable features a true real-time, two-way data sync with your accounting software, including Xero, QuickBooks, NetSuite and Sage Intacct. We built Routable from the ground up to make automated accounts payable as easy as possible, reducing manual tasks and making time for meaningful work.

Take your first step into AP automation with OCR invoice data capture by requesting a demo today or check out Routable's pricing page for details on our current packages.

Recommended Reading

Accounting

What to expect at Sage Transform 2024

The Routable team is proud to be a Platinum sponsor and exhibit at the conference from February 26-29 in Las Vegas. Stop by booth 6 to meet the team, see our AP Automation platform in action with Sage Intacct, and enter for a chance to win an Apple iMac or AirPods Max.

Accounting

Tax management essentials: What you need for year-end filing

In this blog post, we’ll go over common tax forms and deadlines related to gig and contract workers and look at how Routable can help you successfully file for your non-employee workers and entities.